Red Flags in Financial Statements: What a ‘Quality of Earnings’ Analysis Can Reveal That You Might Have Missed!

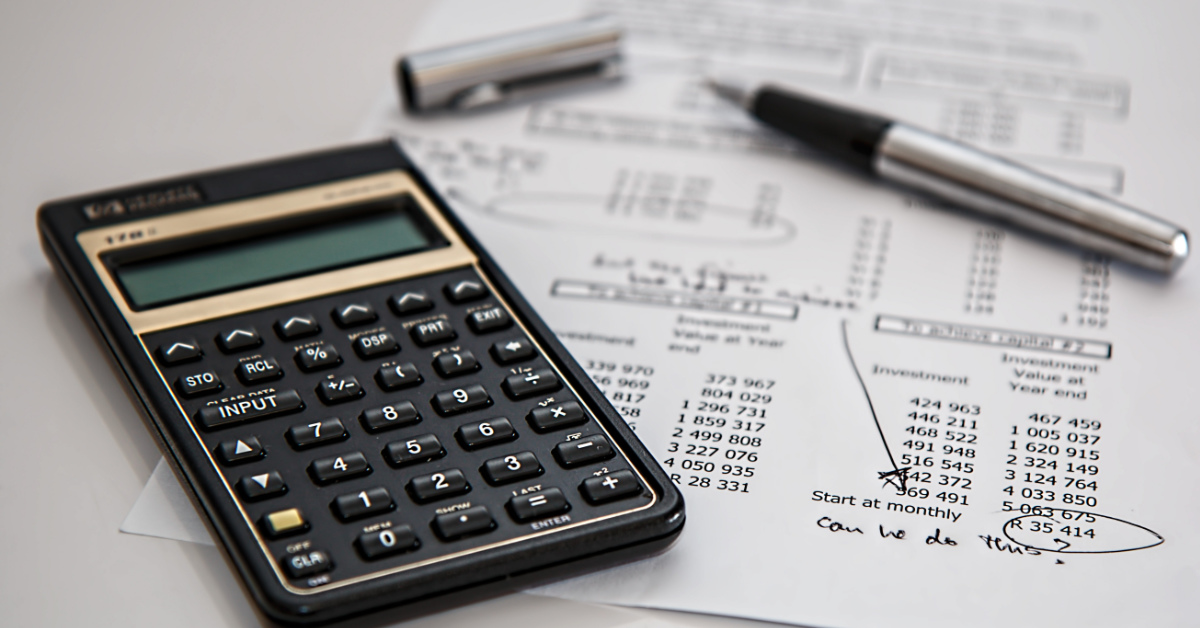

In the high-stakes world of mergers and acquisitions, even seasoned investors can be blindsided by hidden financial pitfalls. A striking example is Hewlett-Packard’s 2011 acquisition of UK-based software company Autonomy. HP paid over $11 billion for Autonomy, only to write down $8.8 billion a year later, citing “accounting improprieties, misrepresentations and disclosure failures” by Autonomy’s management. This debacle underscores the critical importance of conducting a thorough Quality of Earnings (QoE) analysis during the due diligence process. Not as a protocol, but under a precision financial microscope. While standard financial statements may present a company’s performance in a favorable light, a …

From Startup to Scale-Up: The Journey of Indian Entrepreneurs

I have always been intrigued by the story of two salesmen of a shoe making company. One of them was sent to a part of Africa to do market evaluation for starting operations. He came back to report that while the population was large and people had decent money, the culture of wearing good shoes had not set in and hence the idea should be junked. The company was not satisfied. Hence it sent another salesman. He saw the exact same scenes but delivered a report which said ‘amazing business potential, set up immediately. Also connect with a garment making …